M&M Results Q2 F25

Brand

Consolidated PAT for Q2F25 Rs 3,171 cr., up 35%

Strong first half … Consolidated PAT up 27%, RoE 18.9%

Key Highlights

- #1 in SUVs with revenue market share at 21.9%, up 190 bps

SUV volumes up 18% in Q2, 21% YTD Sep - #1 in LCVs <3.5T: market share at 52.3% ^ , up 260 bps

- #1 in Tractors: market share at 42.5%, up 90 bps

- #1 in electric 3 wheelers: market share at 43.6%

- MMFSL AUM up 20%, GS3 within range at 3.8%, end losses down to 1%

- Tech Mahindra EBIT up 490 bps, continued focus on margin expansion

- Consolidated Revenue at Rs 37,924 cr., up 10%

- Consolidated PAT at Rs 3,171 cr., up 35%

- H1 F25 RoE at 18.9%

~ Excluding gains on KG Mobility listing and MCIE sale in Q1 F24

^ Bolero Max Pickup 2T variant classified under LCV 2-3.5T

Mumbai, November 7, 2024: The Board of Directors of Mahindra & Mahindra Limited today approved the financial results for the quarter and half year ended 30 th September 2024.

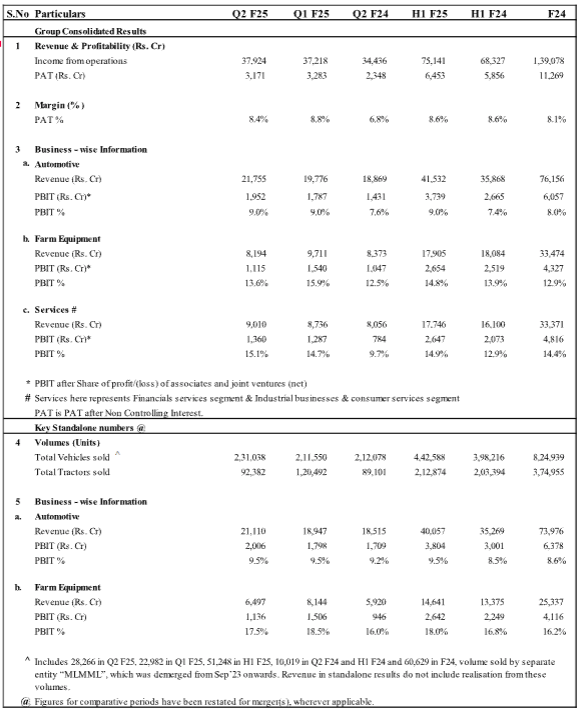

Key financials:| Q2 F25 | Q2 F24 | Growth% YOY | |

|---|---|---|---|

| Consolidated Results | |||

| Revenue | 37,924 | 34,436 | 10% |

| PAT | 3,171 | 2,348 | 35% |

Mahindra & Mahindra reported strong growth across businesses in Q2 of F25 with consolidated PAT of Rs 3,171 cr., up 35%. Auto and Farm delivered robust operating results with profits up 23%. Financial services AUM grew at 20%. TechM showed good traction in BFSI and EBIT improvement of 490 bps. Services delivered 1.8x PAT vs Q2 F24.

Auto

- Highest ever quarterly volumes at 231k, up 9%; highest ever quarterly UV volumes at 136k

- Blockbuster launch of Thar Roxx

- SUV capacity at 54k, up 10% from F24 exit

- Standalone PBIT Rs 2,006 cr., up 34%; PBIT margin 9.5%, up 140 bps (excl. PY gain on LMM transfer)

- Auto Consolidated Revenue Rs 21,755 cr., up 15%

- Auto Consolidated PAT Rs 1,423 cr., up 40%

Farm

- Highest ever Q2 market share at 42.5%; volumes at 92k, up 4%

- Farm machinery Q2 revenue Rs 253 cr., up 14%

- Standalone PBIT Rs 1,136 cr., up 20% and PBIT margin 17.5%, up 150 bps

- Farm Consolidated Revenue Rs 8,194 cr., down 2%

- Farm Consolidated PAT Rs 800 cr., flat due to macro headwinds in international farm markets

Services

- MMFSL AUM up 20%, GS3 at 3.8% improved by 50 bps, standalone PAT up 57%

- Tech Mahindra EBIT margin improved by 490 bps, PAT up 2.5x

- Mahindra Lifespaces residential pre-sales of Rs 397 cr., down 13%

- Club Mahindra total income Rs 371 cr., up 12%

- Mahindra Logistics revenue Rs 1,521 cr., up 11%

- Services Consolidated Revenue Rs 9,010 cr., up 12%

- Services Consolidated PAT Rs 947 cr., up 1.8x

Commenting on Q2 FY25 performance

Dr. Anish Shah, Managing Director & CEO, M&M Ltd. said, “Our businesses have delivered a solid operating performance this quarter. Auto and Farm continued to strengthen market leadership by gaining market share and expanding margins. MMFSL GS3 remained under 4% (at 3.8%) and end losses have improved structurally. TechM delivered a good quarter and the long-term focus remains on reverting to past profitability. Our growth gems are progressing well on the 5x challenge.”

Mr. Rajesh Jejurikar, Executive Director & CEO (Auto and Farm Sector), M&M Ltd. said, “In Q2 FY25, we gained market share across both our Auto and Tractor businesses. SUV volumes increased by 18% YoY, maintaining leadership in revenue market share, with an increase of 190 bps YoY on the back of two successful launches. Volume market share for LCVs <3.5T stands at 52.3%, a rise of 260 bps YoY. The auto standalone PBIT margin was 9.5%, a gain of 140 bps YoY (excl. PY gain on LMM transfer). In our tractor business, we achieved our highest-ever Q2 market share at 42.5%, with standalone margins up by 150 bps YoY.”

Mr. Amarjyoti Barua, Group Chief Financial Officer, M&M Ltd. said, “While the Auto and Farm segments continue to deliver the strong performance we have come to expect of them, this quarter also reflected the strength of our Services portfolio. This has been the trend through H1 F25 and we expect it to continue for the rest of the year in line with our strategy.”

Annexure 1Summary of standalone financials:

| Q2 F25 | Q2 F24 | Growth% YOY | |

|---|---|---|---|

| Standalone Results | |||

| Revenue | 28,919 | 25,762 | 12% |

| EBITDA | 5,270 | 4,360 | 21% |

| PAT | 3,841 | 3,393& | 13%& |

| Volumes | |||

| Total Vehicles sold | 2,31,038# | 2,12,078# | 9% |

| Total Tractors sold | 92,382 | 89,101 | 4% |

& Includes PY gain on LMM transfer

Disclaimer:

All statements included or incorporated by reference in this media release, other than statements or characterizations of historical fact, are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management's beliefs and certain assumptions made by us. Although M&M believes that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which such statement was made, and M&M undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. No assurance can be given that actual results, performance or achievement expressed in, or implied by, forward looking statements within this disclosure will occur, or if they do, that any benefits may be derived from them.

Media Contact:Swati Khandelwal

Sr VP & Head – Group Corporate Communications

Email: [email protected]

Factsheet

(Data in Public domain tabulated for ease of access)