M&M Results Q1 FY25

Brand

Consolidated PAT ₹3283 Crore, up 20%~

Key Highlights

~ Excluding PY gains on KG Mobility and MCIE sale; $ Bolero Max Pickup 2T variant has been classified under LCV 2-3.5T

Mumbai, July 31, 2024: The Board of Directors of Mahindra & Mahindra Limited today approved the financial results for the quarter ended 30th June 2024.

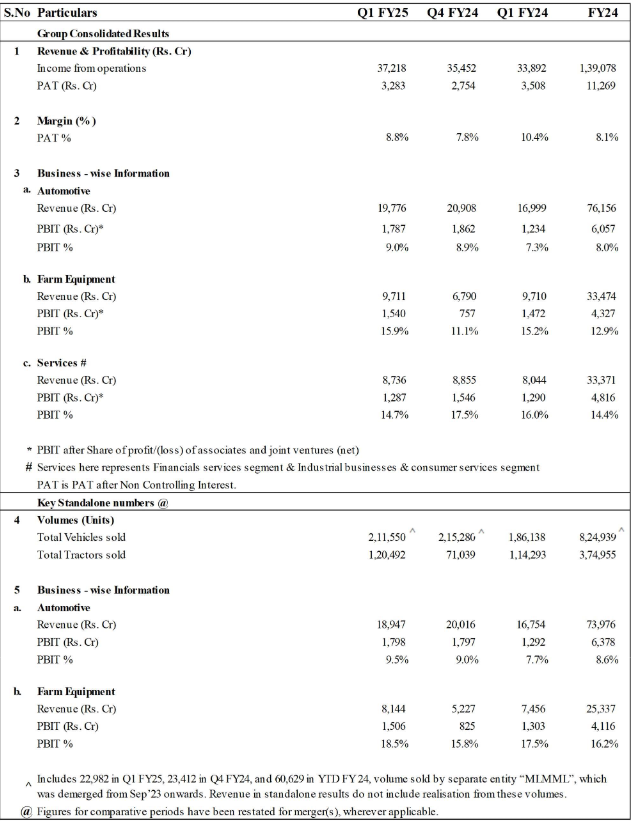

Key financials:

₹ Crore.

| Q1 FY25 | Q1 FY24 | Growth% YoY | |

| Consolidated Results | |||

| Revenue | 37218 | 33892 | 10% |

| PAT | 3283 | 3508 | (6)% |

| PAT (excl. PY gains on KG Mobility and MCIE sale) | 3283 | 2745 | 20% |

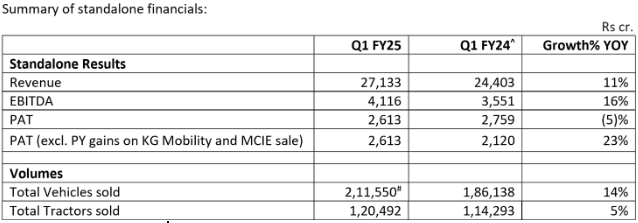

PAT is PAT after Non-Controlling Interest. For summary of standalone financials, refer Annexure 1

Mahindra & Mahindra reported strong operating performance across businesses in the first quarter of F25. Market share gains and continued margin expansion for Auto and Farm, profits up 18%~. Financial services assets quality improvements yielding results, profits up 37%. TechM turnaround commenced, operating performance improving. Growth gems on track to 5x challenge.

Auto

Farm

Services

Commenting on Q1 FY25

performance

Dr. Anish Shah, Managing Director & CEO, M&M Ltd. said, “We have started the F25 fiscal year with strong operating performance across all our businesses. Capitalising on leadership positions, Auto and Farm continued to expand market share and profit margins. Transformation at MMFSL is yielding results as asset quality improves and transformation at TechM has commenced with margins as a key focus. With this momentum and relentless drive towards execution, we will continue to ‘deliver scale’ in F25.”

Rajesh Jejurikar, Executive Director & CEO (Auto and Farm Sector), M&M Ltd. said, “In Q1 F25, we gained market share in both Auto & Farm businesses. We achieved highest ever quarterly tractor volumes and also improved our Core Tractors PBIT margin by 110 bps YoY. We retained market leadership in SUVs with 21.6% revenue market share and in LCVs 3.5T, we crossed 50.9% volume market share. Auto Standalone PBIT grew by 39% with margin improvement of 180 bps YoY.”

Amarjyoti Barua, Group Chief Financial Officer, M&M Ltd. said, “We delivered robust margin expansion across our businesses through focused execution. We continue to meet our external commitments. We have also commenced on our capital investment plans in line with what we communicated in May’24.”

Annexure 1

# Includes 22982 vol sold by separate entity “MLMML”, which was demerged from Sep’23 onwards. Revenue in standalone results do not include realisation from these volumes. ^ Results restated to include the effect of merger of MHEL, MTWL & Tringo

Disclaimer:

All statements included or incorporated by reference in this media release, other than statements or characterizations of historical fact, are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management's beliefs and certain assumptions made by us. Although M&M believes that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which such statement was made, and M&M undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. No assurance can be given that actual results, performance or achievement expressed in, or implied by, forward looking statements within this disclosure will occur, or if they do, that any benefits may be derived from them.

Factsheet

(Data in Public domain tabulated for ease of access)